Hooky Street (part II)

Where it all comes from is a mystery

This is part deux of a series about the cash balance at VusionGroup.

A quick recap. The group reported near on €200m cash at the end of 2023, but only a third of it showed up at the parent. Which seems like a problem, because the accounts also say that subsidiaries pool cash up to that same parent:

I emailed VusionGroup’s investor relations contact a few weeks ago, asking them to explain how it’s cash accounting works. I hadn’t heard back before the first post. Then I got this:

But ménage a trois, what is this?

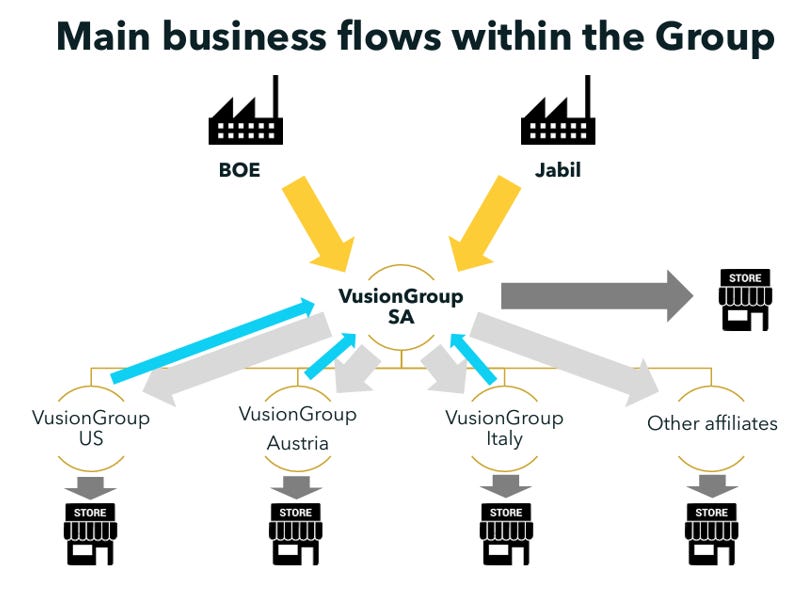

It’s only a chart from a presentation management put together on its half year results (available on its website here). And it confirms that the three main operating subsidiaries - in Austria, Italy and the United States - are in fact all in the cash pool. These entities, plus direct sales by the parent itself, accounted for near enough 90% of total revenue last year.

Large Cognac please, Michael.

Disclosure: I am not an investment professional. None of this is advice. Do your own work. I make mistakes.

Further disclosure: I have emailed VusionGroup investor relations back for clarification. I remain short the company’s shares.

The cash in the US is from the Walmart upfront payment for the expansion of the production lines. This is why Vusion's FCF was so high. The company should clarify this, but it would make sense to not sweep this to the parent company because this is imminently being invested in the expansion of production lines in the Jabil manufacturing lines in Mexico. Nothing to see here.