Hooky Street (part V)

No money back

Consolidated financial statements are the sum of various subsidiary accounts. Sometimes the whole makes less sense than the individual parts. And once in a while that’s because it’s a proper wrong un.

I want to know when that is, so I can bet against it. But it’s tough from the outside looking in. You only get to see pieces of the puzzle. Even when more should be available, they often aren’t.

According to a Deloitte report titled Doing business in Italy:

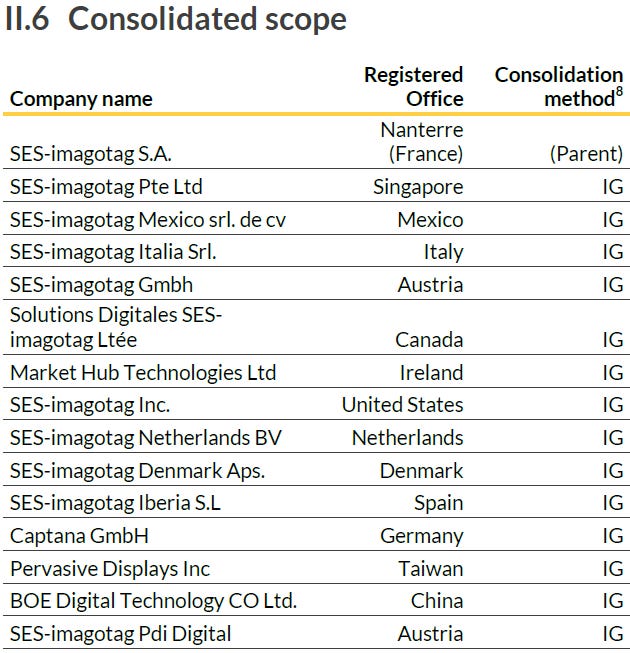

Italy is one of its main operating subsidiaries, but VusionGroup doesn’t seem to have bothered with this reporting requirement since 2021. Mind you, the subs in Germany, Spain, Ireland and Singapore haven’t filed since then either. The one in the Netherlands, not since 2019.

This makes reconciling the 2023 cash position tricky (but not impossible).

So today I’m going to start with something a little easier. Instead of asking where all VusionGroup’s cash was sitting at the end of last year, let’s see if we can work out where it was in the 2021 accounts.

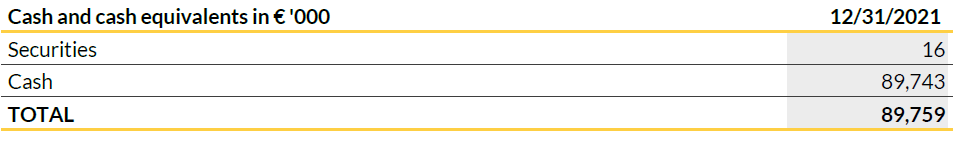

At group level there’s:

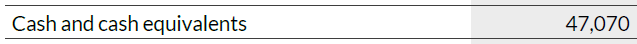

And the French parent has:

So that leaves €43m sat across these 14 subsidiaries:

Helpfully, 2021 accounts have been field for both subs in Austria and the ones in Denmark, Germany, Ireland, Italy, Singapore and Spain. We can break down the cash position a lot more with these:

So, just the €40m odd left to find.

We can be pretty sure it wasn’t sat in the Netherlands. There was no cash there last time it filed, in 2019. And the 2021 group accounts disclose that it required a comfort letter from the parent:

So the €40m was in North America or Asia, right?

Well, it could have been. But if it was, how did it get there? I mean, the previous year the unaccounted for cash balance in these subsidiaries was barely €20m. And then where did it go? Because at the end of 2022 there was only about €10m in subsidiaries that I don’t have filings for.

That’s enough work for one day, I’m off down the Nag’s Head. I’ll have a go at finding the cashflow needed to make the numbers add up in the next post (spoiler: I can’t, but feel free to try for yourself).

Disclosure: Until I get an explanation for VusionGroup’s cash balance that makes sense to me I am short the company’s shares. Unfortunately the company’s investor relations have said they won’t respond to any more of my questions about it.

Further disclosure: I am not an investment professional. None of this is advice. Do your own work. I make mistakes.