91 + 45 + 11 = 120

Trade receivables accumulate when customers don’t pay.

VusionGroup’s parent company reported a balance of €130m at the end of 2021:

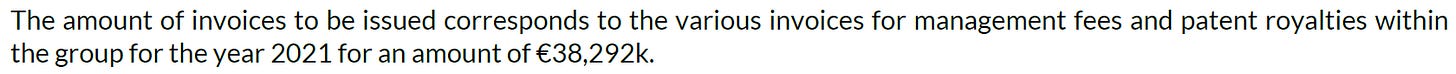

But that included about €39m of accrued income:

Apparently these are pretty much all sales booked to subsidiaries, where no invoice has been raised:

I have a funny feeling we’ll be coming back to this line item in another post. For now we can just knock the intra-group balance off of trade receivables to see how much is owed by real customers.

Something like €91m.

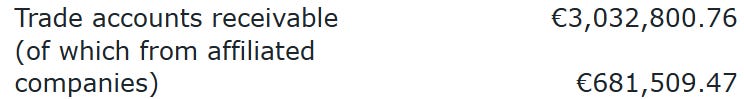

For the group’s main operating subsidiary in Austria the trade receivables balance was:

Call it €45m.

Plus there was a few in Italy:

Germany:

Ireland:

And the other Austrian subsidiary:

I’ll let that lot go for €11m.

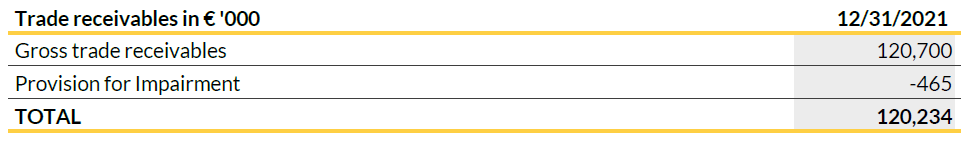

So on consolidation you get:

€120m.

You do the math.

Disclosure: Until I get an explanation for VusionGroup’s cash balance that makes sense to me I am short the company’s shares. Unfortunately the company’s investor relations have said they won’t respond to any more of my questions about it.

Further disclosure: I am not an investment professional. None of this is advice. Do your own work. I make mistakes.