Hooky Street (part XI)

Fin

VusionGroup’s accounts appear to be massively mis-stated. That might be down to incompetence, but I think it is more likely deliberate. I’ve been questioning the company’s numbers on here for a few months now. To see why I started to believe they are made up, we need to go back a bit further…

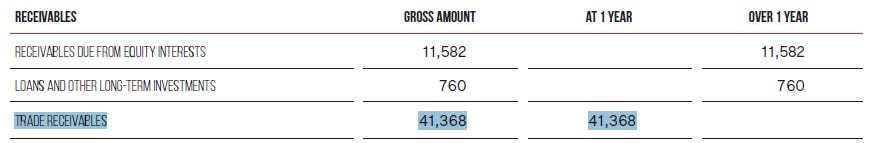

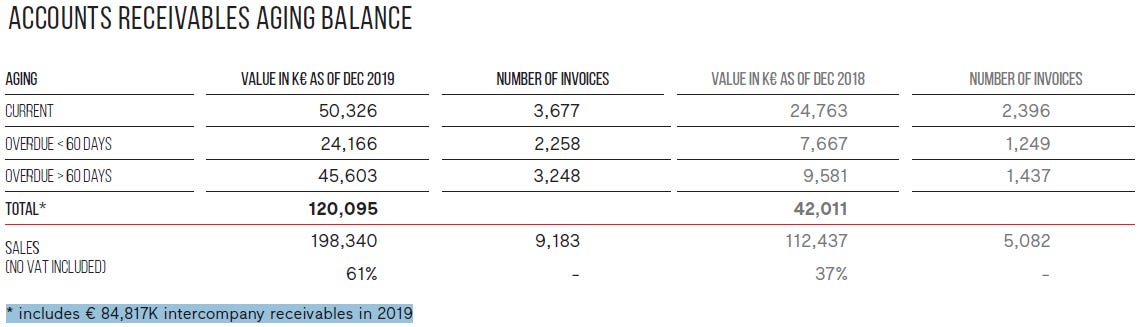

In 2018 VusionGroup’s French parent company reported trade receivables from customers of €41m (none older than a year):

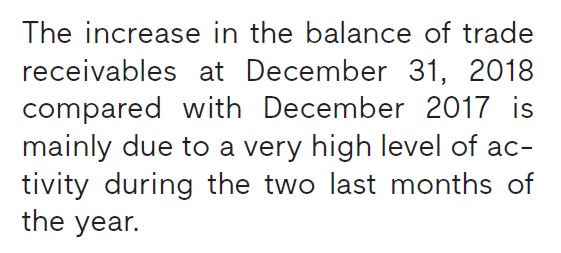

There’s a short explanation of the increased balance:

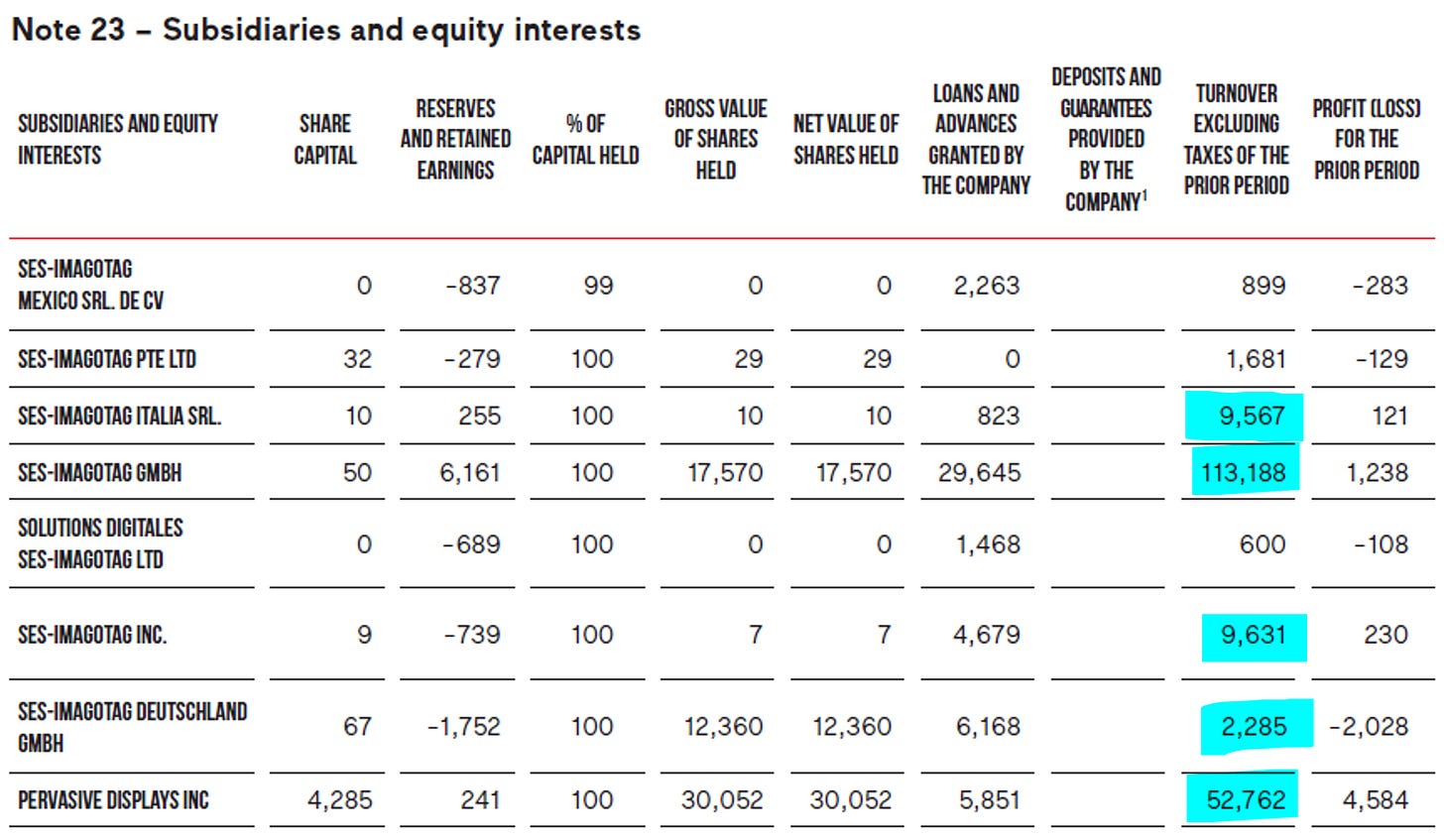

But that can’t be true if the rest of the group accounts are right, because the French parent apparently had no external revenue at all in 2018! Consolidated revenue of €188m is all accounted for by sales at subsidiaries (basically Austria, Italy, Germany, the US and Taiwan):

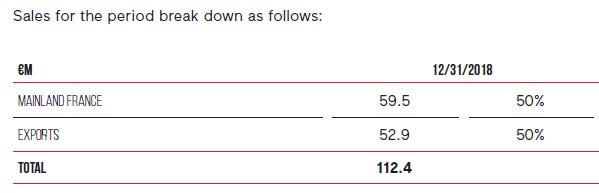

So the parent’s revenue was all intra-group? And yet its financial statements say it still made sales in France of €60m:

Who to, there’s no other French entity within the group? (And at least try and make the percentages match if you don’t want it to seem like you are making the sales up).

Now there’s nothing at all in the 2018 accounts to suggest that any of the €41m trade receivables balance at the French parent is owed by other entities within the group. But someone must have realised how obviously made up the numbers look. For the 2019 balance we get an asterisk:

If only it was that was easy. The bitch about double entry bookkeeping is that every asset has a matching liability - which in this case should be sitting on a subsidiary balance sheet.

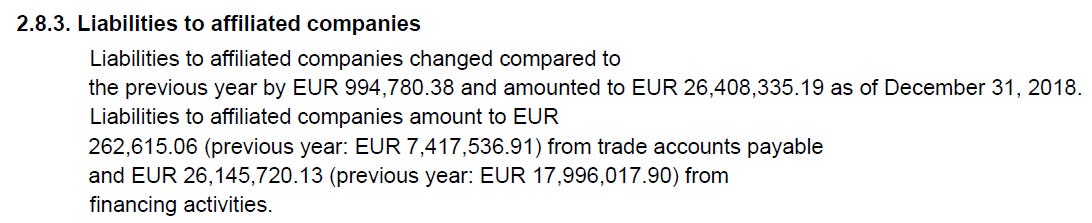

But there’s only one subsidiary (Austria) even close to big enough to have trade payables of tens of millions due to the parent in 2018. And it doesn’t (there’s a couple of hundred thousand):

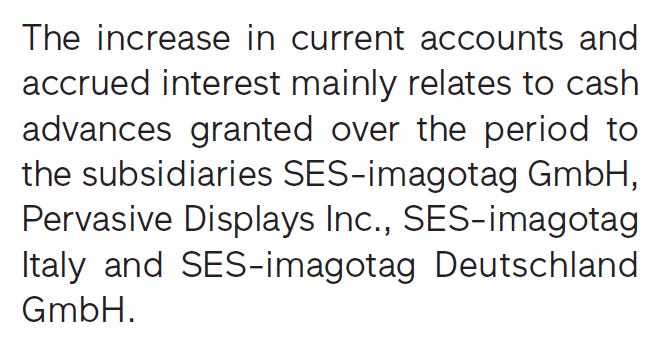

The €26m it owes internally is virtually all accounted for under ‘Current accounts’ on the parent balance sheet, not as ‘Trade receivables’ :

So who owed the French parent around €40m in trade payables at the end of 2018…? And where are the corresponding sales?

Management has the same problem when it tries to use intra-group balances to explain why receivables don’t add up today. There’s no matching liability in the subsidiaries.

By way of example, in 2023 the Austrian entity accounts show it owed €627m to the parent, of which €107m was classed as trade payables:

But all of this was booked under ‘Current assets’ or ‘Accrued income’ in the French parent accounts, and I already deducted the latter from the ‘Trade receivables’ number when I did the sums. You can’t take it off again and pretend the balances add up!

VusionGroup’s accounts have been full of holes since (at least) 2018. And it still looks like they are. If you own it your money will probably fall down one sooner or later.

Disclosure: Until I get an explanation for VusionGroup’s cash, receivable, accrued income and intangible asset balances that makes sense to me I am short the company’s shares. Unfortunately the company’s investor relations have said they won’t respond to any more of my questions about it.

Further disclosure: I am not an investment professional. None of this is advice. Do your own work. I make mistakes.